Create and send a payment links.

Send payment links to your customers and track the status.

Our easy-to-navigate Blink platform allows you to create, send, and track payment links for your customers.

Payment links are individual and unique one-use payment pages that you can send to customers via email or SMS.

Your customers can then choose from multiple payment options to pay via card, open banking or set up a Direct Debit.

We are fully integrated with Apple Pay and Google Pay, so your customers can conveniently pay using these methods.

Payment links are also tracked, so you can monitor how your customer has interacted with the link.

Navigation.

Under the “Payments” tab on the left-hand navigation bar, click on “Request a payment”

How does it work?

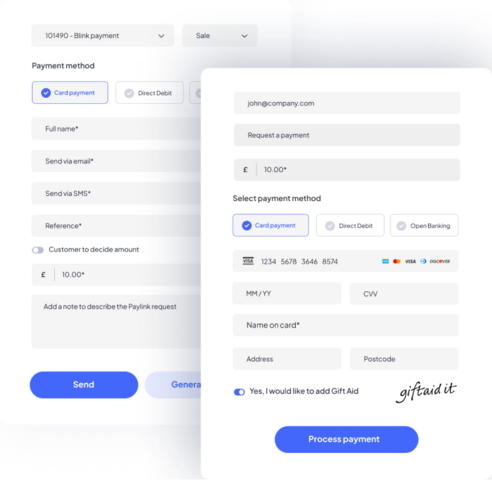

Select which Merchant name/ID you’d like to take a payment from.

Choose the type of transaction from the drop-down menu listing: sale, pre-auth or verify.

Sale: An immediate payment transaction

Pre-auth card: Confirms the customer has sufficient funds available. No funds are taken or ringfenced. You have 30 days to capture the payment

Verify: Confirms the card’s authenticity and can be used as an anti-fraud check

Payment type.

- Once the type of transaction has been selected, you have payment options to choose from, dependent on the payment rails setup on your account:

Card payment

Direct Debit

Open banking

(Please note that pre-auth and verify are only available on card payments).

When you create your payment link, choose which of the above options you offer your customer. You can select one or multiple payment types.

Finally, enter the customer’s details, including the customer’s e-mail address or phone number to whom the payment link request should be sent to.

Process the payment.

When processing the payment, choose whether to take this immediately or delay the capture.

This feature needs to be enabled on the payment preferences page by a lead user.

To send a payment link with delayed capture, select the number of days to delay the payment. After the specified number of days, the payment will be automatically processed.

Please note that the maximum delay allowed is 30 days.

Although the maximum delay is 30 days, some banks may release the funds earlier.

Once the customer fills in their card details, a hold will be placed on the funds in their account, but the actual capture will be deferred until the specified date.

The days are counted from when the customer pays this payment link, not from when you have created it.

After setting up the delayed capture, the payment will be automatically captured at the scheduled time. However, you can also capture it manually and earlier than the scheduled time. To do so, go to the Blink card transaction page under the reporting section, locate the specific transaction, and click on the capture button.

When capturing early, you can charge customers a partial amount.

Reminders.

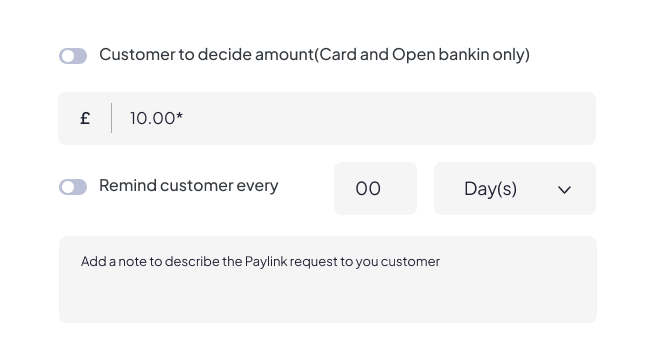

On our Blink platform, you can also automatically remind your customer of an unpaid payment request.

How do I set up a reminder?

Choose to send payment reminders for unpaid payment links automatically. You can enable reminders for individual payments while creating the payment link or for all new payment requests as a blanket rule.

Reminders can be switched on for all payment requests (only for new requests) or these can be manually selected.

To switch on reminders for individual requests, you must provide either an email or SMS. If neither is filled in, the system will display an error pop-up message, prompting you to enter an email or phone number. Alternatively, you can turn off the reminder. Once the customer has paid, the reminders will stop automatically.

You can toggle reminders on/off on individual requests.

When does Blink send a reminder?

When does Blink send a reminder?

During setup, you can choose how often you want to remind the customer. If the customer has not paid by the date set on the requested payment reminder, the system will automatically send them a reminder at 12:00 PM (GMT/BST) on that day.

The reminder email will be the same as the initial email. You can easily track the reminders sent on the requested payment page.

Adjusting payment request reminders

On the requested payments page, you can turn off reminders or edit the schedule for a specific payment request. The clock icon indicates that a reminder is set for this link.

Create a blanket rule for all payment links

You can decide to send reminders to all new payment links on the payment preferences page (under “Payment operations”). However, you can also switch this off for individual payment links when creating a new payment or once the payment link has been sent.

Expiry date

Choose an expiry date for your payment link.

FAQ’s & Troubleshooting.

How can I change the contact name my client will see on the SMS?

The customer will receive a text message from BLINK, with the link in the message.

If you want to change the contact name to something else, head to your merchant shop settings in the Blink page “Customiser” and add your contact name to the payment link SMS name input.

Please note that the name can only contain simple numbers and letters and has an 11-character maximum limit.

Can I request payment links in different currencies?

When you set up a merchant account with us, you will be asked which currency you would like to use to process transactions, you can request additional currencies at any time.

Additional currencies are currently only applicable with card payments and open banking.

Will my customer receive a receipt?

When a payment link has been successfully processed, the customer will receive their receipt.